by Nicholas Mitsakos | Artificial Intelligence, China, Economy, Globalization, Innovation, Investment Principles, Technology, Transformative businesses, Writing and Podcasts

Chairman Xi faces more significant problems than just a declining stock market. Future prosperity, innovation, and China’s global position in advanced technologies are at stake. Bureaucratic regulation and central government money are not the answer, and an uncomfortable truth for communist bureaucrats is that a free market, access to venture capital and private equity, and vibrant public markets are essential for China’s success. A volatile market is still best at attributing value and allocating capital over time. China’s entrepreneurs have brilliance, incomparable fortitude, and a strong work ethic, but without capital and liquidity for that capital, the ship will run aground. Permanent capital is essential for the growth of an economy, innovation, and prosperity. Liquidity is essential for that capital.

by Nicholas Mitsakos | Book Chapter, China, Economy, Globalization, Public Policy, Trade, Transformative businesses, Writing and Podcasts

Isolationism, fragmentation, and pessimism always fail. Globalization has been everyone’s favorite punching bag for a while. It is hard to feel optimistic about its prospects. However, globalization has a better future. If you are a fan of globalization, cooperation, and comparative advantage, the last decade has been extremely challenging. Ten years ago was a time of optimism on a global scale. However, economic and geopolitical forces have combined to add friction and fragmentation to global exchange. The benefits are now even greater and with everyone’s self-interest and mutual benefit, this geopolitical stalemate will pass – more quickly than is commonly thought today. Cooperation, integration, and mutual benefit win in the end. It is a time to be optimistic once again.

by Nicholas Mitsakos | Book, Book Chapter, Economy, Innovation, Investment Principles, Public Policy, Science, Technology, Trade, Writing and Podcasts

Zero-sum thinking has begun. Despite comparative advantage, mutual cooperation, and specialization proving indisputably more beneficial than any other approach to economic interaction, this ideal is under threat. Rules and norms for economic integration lifted hundreds of millions of people out of poverty, created an order-of-magnitude increase in the average wealth of the Western population, and benefited countless hundreds of millions enabling a way of life otherwise unimaginable post-World War II. Now that system is under threat as developed countries subsidize alternative energy, attract manufacturing via expensive subsidies, and restrict the flow of goods and capital. Mutual benefit is out; national gain is now the highest priority. In other words, stupidity and zero-sum thinking have taken over. A handful of bureaucrats, regardless of how brilliant each may be, can never equal the mind of the market. Management and control usually spell disaster eventually. Managed focus on technological development for products and services the central government believes have greater substantial benefit to the overall society may not be calamitous, but the law of unintended consequences has not been repealed. It will be inefficient, substandard, and create potentially dangerous side effects. Innovation, creative freedom, and unstructured thought are essential components to the development of any technology of substance and disruptive benefit.

by Nicholas Mitsakos | Artificial Intelligence, Biotechnology, Book, China, commodities, Digital Assets, Economy, Financial Technology, Public Policy, Russia, Technology, Transformative businesses, Writing and Podcasts

This book explores the next decade’s more frequent and intense economic, geopolitical, fiscal, and market volatility, technological innovation, disruption, and hype.

Long-term opportunity exists, and this book uses a 10-year horizon as a surrogate for a long-term perspective. Some of the world’s most important industries are being disrupted, especially finance via digital assets and Blockchain-based businesses, life sciences via gene editing, DNA sequencing, and CRISPR, and communications via advanced wireless data networks, software technologies including artificial intelligence, and new interactive platforms such as the Metaverse.

by Nicholas Mitsakos | China, Investment Principles, Public Policy, Russia, The Market, Writing and Podcasts

While most of Europe and the United States suffer sweltering heat, darkening economic skies and bitter winter of discontent are looming. Threats to the world economy are chilling. Rising interest rates are slowing activity for discretionary spending while rising prices for nondiscretionary spending are also slowing economic activity. It would be miraculous if the compounding of both effects would not lead to a recession in both Europe and the US. China’s growth has stalled. The Ukraine conflict will ultimately resolve itself to the West’s dramatic disadvantage and the West seems to be willing to let it happen – much to each economy’s long-term disadvantage. Don’t count on anything miraculous.

by Nicholas Mitsakos | China, commodities, Economy, Investments, The Market, Writing and Podcasts

Beyond 2022, higher interest rates and slower global growth most likely trigger a market correction, perhaps at an exorbitant cost. As discounts rates rise and growth assumptions lower, many stocks based assumptions that low interest rates and high growth would sustain for many years will see dramatic repricing and much lower valuations.

Energy and commodities, and the businesses associated with them, are in for a very bumpy ride, but there is a fundamental sustainability to their cash flow and long-term attractiveness as world supply reorders. That which is essential prevails.

The luxury of thinking we have halcyon days of global growth and geopolitical stability may not be with us for some time to come. It is perhaps time to plan for that now.

by Nicholas Mitsakos | China, Economy, Investment Principles, Investments, Public Policy, Writing and Podcasts

Collectively, the world is good at screaming about all sorts of immediate and looming crises, whether that is climate change, totalitarian governments abusing civilians and trampling on personal rights or outright genocide. A speech and a prayer suffice but we’re not going to do anything. Donation websites, lighting buildings in flag colors of abused nations, and sending hopes and prayers accomplish nothing. We send prayers. We just won’t answer them. The Ukraine war’s consequences are severalfold. Economically, global consequences may be slower and less spectacular than the dramatic Russian military invasion. But, the effects will permeate the global economy, and Russia will be the biggest long-term loser. While this does not comfort families suffering and dying in the streets of Ukrainian cities, it realigns global industries and economies, strengthens the West, and is likely to galvanize United States’ leadership in the global economy – setting up even more intense rivalry China. A big uncompromising response now is the most likely strategy to settle these dramatic issues – and if it leads to regime change in Russia, that helps everyone, especially the Russians. The US and the EU need to grow up and start acting like global leaders.

by Nicholas Mitsakos | Book Chapter, China, Public Policy, Trade, Writing and Podcasts

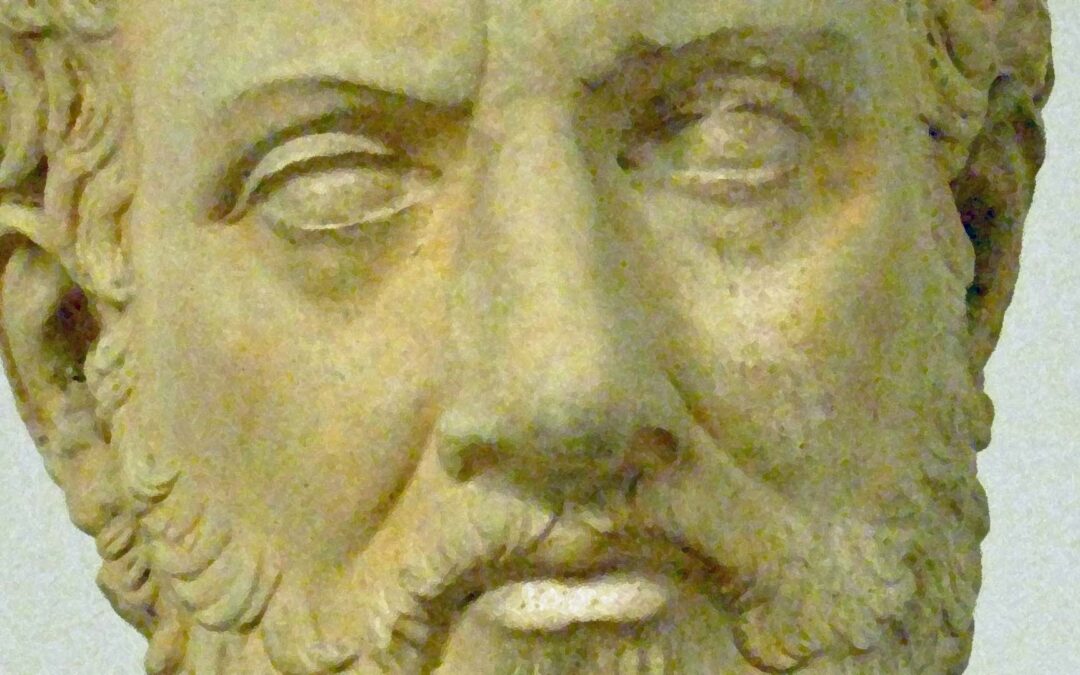

The “Thucydides trap” is where a rising nation-state – for Thucydides it was Athens – must eventually have a violent confrontation with the existing dominant nation-state – Sparta in his time. It is a zero-sum game where there can be only one dominant nation-state as the eventual winner – and it is usually assumed to be the rising nation-state outdoing the dominant nation-state.

Today, many “experts” (and I have great disdain for self-proclaimed experts) believe this is the circumstance between the US and China. We are headed toward violent confrontation where there can be only one winner. I read the book by Thucydides about the conflict between Athens and Sparta (I cannot be dispassionate here about that outcome because my family is from Sparta on my father’s side). But I fundamentally disagree with Thucydides’s historical descriptions being used as analysis by anyone to describe global events, especially those between the US and China.

by Nicholas Mitsakos | Currency, Economy, Investment Principles, Investments, Public Policy, Trade, Writing and Podcasts

We are rapidly approaching a zero-interest rate world. Interest rates are being driven to zero (or below zero in many cases) as a first-line tool for central banks to generate economic activity in the face of the dramatic negative impact of the pandemic, as well as existing and lingering economic fallout. This toolbox will be empty soon, and the only remaining weapon will be fiscal policy. Among other things, fiscal policy and domestic financial markets will have an overwhelming influence on global currencies. Capital flows will dramatically impact currency volatility as capital moves to more attractive countries with more liquid and robust asset markets.

by Nicholas Mitsakos | China, Economy, Trade, Transformative businesses, Writing and Podcasts

A global economic and political chess game is on between the United States and China. There are many moves, defensive and offensive strategies, short- and long-term gains, but, unlike chess, mutual victory is possible. But only if the U.S. and China understand each piece, all the potential moves, what can be sacrificed, and what victory really looks like. But this does not appear to be happening. Instead of working for mutual benefit, regardless of fundamental cultural and political differences, we are now drawing bright lines demarking battle zones. The result will be economic and technical inefficiency and degradation in the quality of life, safety, and prosperity for everyone.

by Nicholas Mitsakos | Book Chapter, China, Economy, Investments, Writing and Podcasts

Chinese economic policies and motivations since 2008 not only emphasize growth and sustainability of state-owned enterprises but, a critical but much less well-appreciated dimension is the Chinese government’s emphasis on stability. No economic policy in China will ignore this, and the high value placed on stability pervades all the current trade talks with the United States.

by Nicholas Mitsakos | Book Chapter, China, Economy, Technology, Writing and Podcasts

While it may seem tempting to target attractive market sectors and provide government-backed capital and direction, this typically does not end well. The efficient allocation of capital, demanding an appropriate return for given risks, is something private markets do extremely well. A handful of bureaucrats cannot match the collective wisdom of the capital markets, no matter how attractive the target.