by Nicholas Mitsakos | Book Chapter, China, Globalization, Public Policy, Taiwan, Technology, Trade, uncertainty, Writing and Podcasts

The global investment landscape has reached a structural inflection point. Geopolitical realignments, industrial policy, and national security concerns are reshaping the era of frictionless globalization. At the center of this transformation is the intensifying strategic competition between the United States and China. The US is acting belligerently toward China in trade negotiations, threatening exorbitant tariff rates and trying to build walls around China’s international trade activity. All this may be a high-volume attempt to bring China to the table to strike a better trade arrangement. While this tactic is unprecedented, we may only be in the third inning of a nine-inning game. The current geopolitical and economic transition is both a challenge and a multi-decade opportunity. Capital will increasingly flow to regions that demonstrate policy consistency, innovation capacity, and demographic vibrancy. Strategic sectors such as AI, defense, semiconductors, energy, digital infrastructure, and cybersecurity will drive private and public investment. Embracing this new reality of regional diversification, thematic depth, and geopolitical foresight will position participants to thrive. As multipolarity replaces global uniformity, success lies with active, strategic alignment with the forces shaping the next economic era.

by Nicholas Mitsakos | Book Chapter, China, Economy, Globalization, irrationality, Public Policy, Taiwan, Trade, uncertainty, Writing and Podcasts

A turbulent geopolitical and economic environment is here to stay. Allocating capital in today’s economic and geopolitical landscape requires a sharp focus on macro trends, a disciplined approach to risk, and an ability to anticipate shifts in policy and global power dynamics. The investment landscape has never been more complex, with heightened tensions between the U.S. and China, uncertainty surrounding Taiwan, and Europe’s economic fragility. The new reality is that trade realignments, subsidized industrial policies, and emerging trading blocs characterized by protectionism and localization are rising. Now What?Geopolitical risk is no longer an afterthought. The US-China rivalry, Taiwan’s strategic importance, Europe’s economic fragility, and shifting trade policies will shape the next decade of global markets. Savvy investors will anticipate these changes and allocate capital to industries and regions positioned for sustained growth. The key to success is flexibility, resilience, and the ability to recognize macro trends before they materialize fully. The future is uncertain but full of opportunities.

by Nicholas Mitsakos | Artificial Intelligence, Book Chapter, China, commodities, Currency, Economy, Globalization, Innovation, Trade, Writing and Podcasts

The United States and China play global economic and political chess games. There are many moves and defensive and offensive strategies, not only for trade but also for energy and natural resources (rare earths among the most recent flavors of discord), geopolitics (Russia, Ukraine, Iran, the Middle East generally), technology (Taiwan and AI), and global economic supremacy. It’s a long list, but China and the US drive the outcomes. Instead of working for mutual benefit, regardless of fundamental cultural and political differences, we are now drawing bright lines demarking battle zones (Ukraine and Russia; Taiwan; AI and advanced technologies). The result will be economic and technical inefficiency and degradation in the quality of life, safety, and prosperity. China must acknowledge the outrage caused by its overreaching bids for control, and America must adjust to China’s presence without selling honor for profit. Competition is not us-or-them; reality is us-and-them. The U.S. semiconductor industry gets 30% of its revenue from China. China’s resulting products service the world, and China’s producers need the U.S. as well. If allowed, such examples of mutual benefit will proliferate. It is naïve to imagine wrestling China back to the past. The project, now, is to contest its moral vision of the future. Connected, collaborative engagement is the only practical way. China has come a long way, and its trajectory cannot be ignored or dismissed. The U.S. and China will be much better off from this more enlightened, realistic perspective. See the whole board.

by Nicholas Mitsakos | Book Chapter, China, Economy, Globalization, Public Policy, Trade, Transformative businesses, Writing and Podcasts

Isolationism, fragmentation, and pessimism always fail. Globalization has been everyone’s favorite punching bag for a while. It is hard to feel optimistic about its prospects. However, globalization has a better future. If you are a fan of globalization, cooperation, and comparative advantage, the last decade has been extremely challenging. Ten years ago was a time of optimism on a global scale. However, economic and geopolitical forces have combined to add friction and fragmentation to global exchange. The benefits are now even greater and with everyone’s self-interest and mutual benefit, this geopolitical stalemate will pass – more quickly than is commonly thought today. Cooperation, integration, and mutual benefit win in the end. It is a time to be optimistic once again.

by Nicholas Mitsakos | Book, Book Chapter, Economy, Innovation, Investment Principles, Public Policy, Science, Technology, Trade, Writing and Podcasts

Zero-sum thinking has begun. Despite comparative advantage, mutual cooperation, and specialization proving indisputably more beneficial than any other approach to economic interaction, this ideal is under threat. Rules and norms for economic integration lifted hundreds of millions of people out of poverty, created an order-of-magnitude increase in the average wealth of the Western population, and benefited countless hundreds of millions enabling a way of life otherwise unimaginable post-World War II. Now that system is under threat as developed countries subsidize alternative energy, attract manufacturing via expensive subsidies, and restrict the flow of goods and capital. Mutual benefit is out; national gain is now the highest priority. In other words, stupidity and zero-sum thinking have taken over. A handful of bureaucrats, regardless of how brilliant each may be, can never equal the mind of the market. Management and control usually spell disaster eventually. Managed focus on technological development for products and services the central government believes have greater substantial benefit to the overall society may not be calamitous, but the law of unintended consequences has not been repealed. It will be inefficient, substandard, and create potentially dangerous side effects. Innovation, creative freedom, and unstructured thought are essential components to the development of any technology of substance and disruptive benefit.

by Nicholas Mitsakos | Book Chapter, China, Public Policy, Trade, Writing and Podcasts

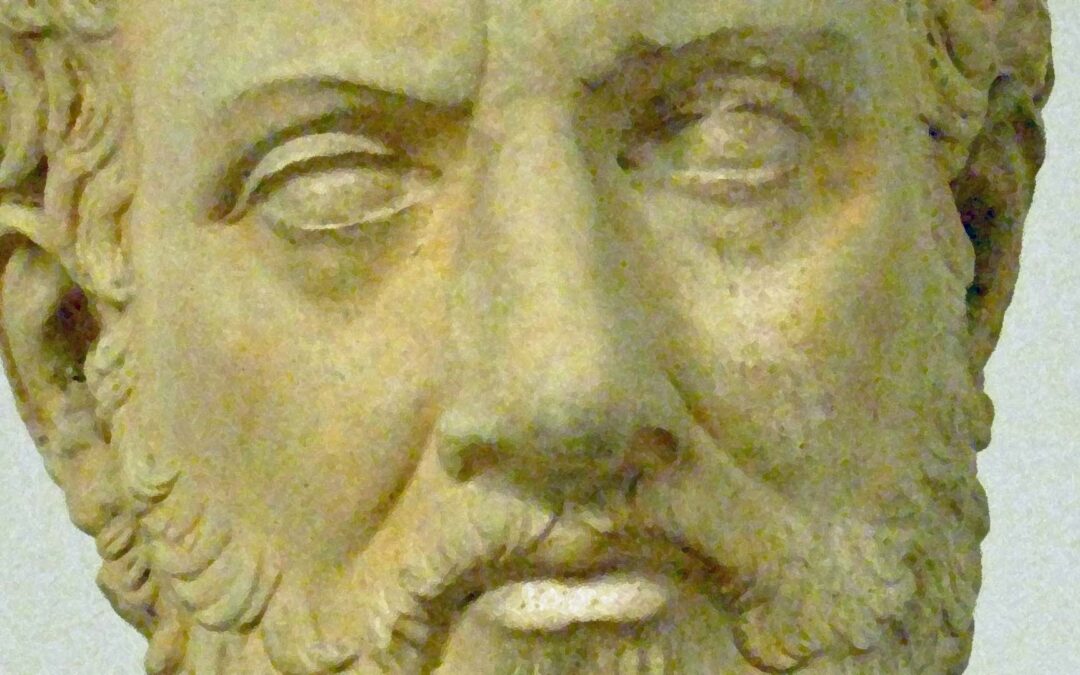

The “Thucydides trap” is where a rising nation-state – for Thucydides it was Athens – must eventually have a violent confrontation with the existing dominant nation-state – Sparta in his time. It is a zero-sum game where there can be only one dominant nation-state as the eventual winner – and it is usually assumed to be the rising nation-state outdoing the dominant nation-state.

Today, many “experts” (and I have great disdain for self-proclaimed experts) believe this is the circumstance between the US and China. We are headed toward violent confrontation where there can be only one winner. I read the book by Thucydides about the conflict between Athens and Sparta (I cannot be dispassionate here about that outcome because my family is from Sparta on my father’s side). But I fundamentally disagree with Thucydides’s historical descriptions being used as analysis by anyone to describe global events, especially those between the US and China.

by Nicholas Mitsakos | Currency, Economy, Investment Principles, Investments, Public Policy, Trade, Writing and Podcasts

We are rapidly approaching a zero-interest rate world. Interest rates are being driven to zero (or below zero in many cases) as a first-line tool for central banks to generate economic activity in the face of the dramatic negative impact of the pandemic, as well as existing and lingering economic fallout. This toolbox will be empty soon, and the only remaining weapon will be fiscal policy. Among other things, fiscal policy and domestic financial markets will have an overwhelming influence on global currencies. Capital flows will dramatically impact currency volatility as capital moves to more attractive countries with more liquid and robust asset markets.

by Nicholas Mitsakos | China, Economy, Trade, Transformative businesses, Writing and Podcasts

A global economic and political chess game is on between the United States and China. There are many moves, defensive and offensive strategies, short- and long-term gains, but, unlike chess, mutual victory is possible. But only if the U.S. and China understand each piece, all the potential moves, what can be sacrificed, and what victory really looks like. But this does not appear to be happening. Instead of working for mutual benefit, regardless of fundamental cultural and political differences, we are now drawing bright lines demarking battle zones. The result will be economic and technical inefficiency and degradation in the quality of life, safety, and prosperity for everyone.