Tech Policy and Unintended Consequences

Technology is facing policy changes with global resonance, such as China’s new crackdown, the rising resistance to social media, and government’s desire to manage and control technological development. “I’ll build a wall and we will be fine...

Tech Policy and Unintended Consequences

Technology is facing a substantial crossroads as policy changes with global resonance, such as China’s new crackdown on the country’s big tech companies (such as Ant Financial and Didi Global), the rising resistance to social media behemoths like Facebook, and the need for governments, whether in the United States, Western Europe, or China, to manage and control technological development. Regardless of any good intentions, this will add friction, inefficiency, and underperformance to the most dynamic global industry. The best intentions usually bring disastrous consequences. China cannot escape the law of unintended consequences. Trying to “manage” innovation and creativity takes away the often unplanned and serendipitous breakthroughs that make many significant advancements possible in the first place. From an economic perspective, capital is not going to invest in an uncertain environment where prosperity is managed and, despite great risk where most ventures will fail, the truly successful ones which make up for the losses and encourage capital to keep investing, will be mitigated. The vanguard of capital flight from China is beginning, and it will not ease if this policy and attitude are not revised. This attempt at “fairness and more equal distribution” will do nothing more than keep capital away and stifle any attempt at creativity, technical innovation, and economic advancement. The intention of this policy will yield the opposite outcome as a consequence. The signal means substance. Substance means innovation, creativity, and competitive dynamics that create the most effective innovations, the best solutions, and the most sustainable companies. Central planning, bureaucratic industrial policy, government-led economic management, and dictatorial focus have always failed, and always will. The US should not fall into this trap, regardless of how appealing it may be.

It is only noise.

Noise and Unpredictability

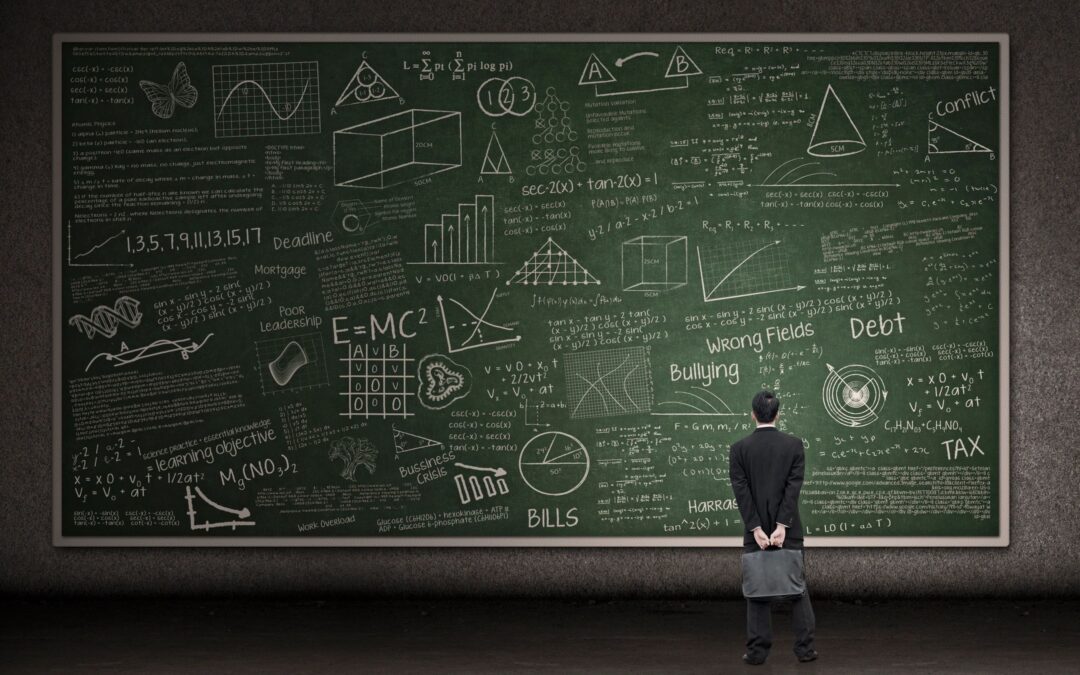

Separating signal versus noise is challenging these days because today’s signal is more muddled than ever. One of the more unusual circumstances, which I covered in more detail in the article “Important and Unknowable” is that the immediate past is telling us extraordinarily little about the near future. That is unusual because we can typically estimate the near-term by connecting the dots with reasonable depth and data from the recent past.

One of the reasons why people have inflation fears, currency tremors, market jitters, and emotional vacillation between joy and terror is that all these outcomes seem equally likely that any sense to realistically gauge the directions of these key metrics. We can usually rely upon near-term data to predict the near-term future, and that usually gives us a reasonable sense of comfort about the markets, and how to plan, prepare, predict, and withstand anticipated market moves. But that does not seem to be the case now.

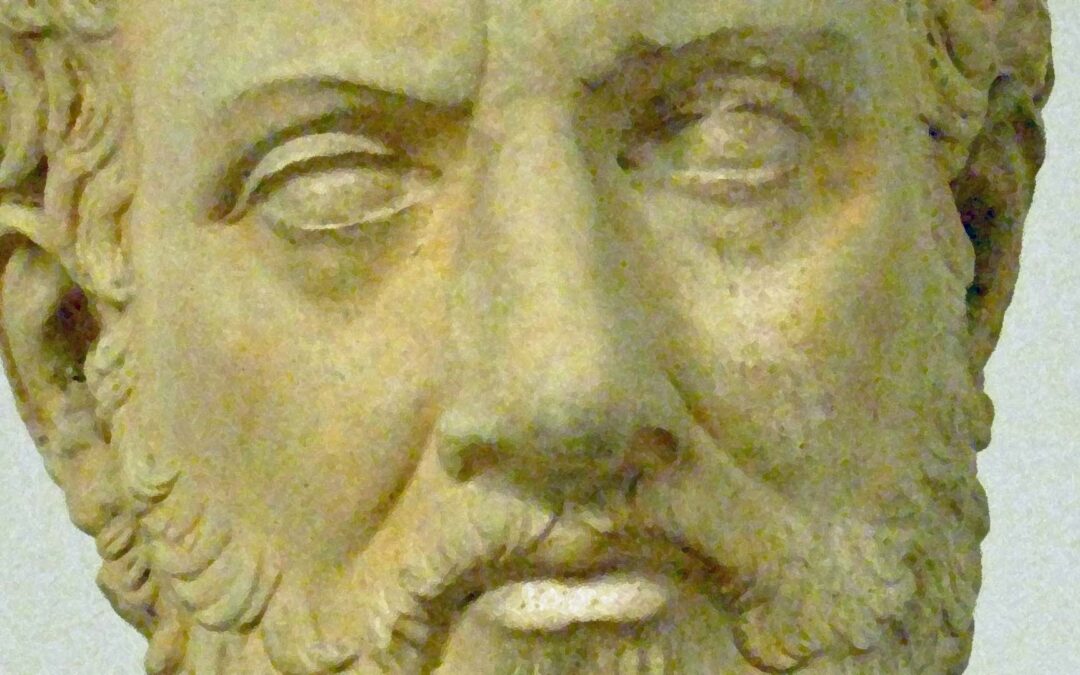

CHINA, THE US, AND THE THUCYDIDES TRAP

The “Thucydides trap” is where a rising nation-state – for Thucydides it was Athens – must eventually have a violent confrontation with the existing dominant nation-state – Sparta in his time. It is a zero-sum game where there can be only one dominant nation-state as the eventual winner – and it is usually assumed to be the rising nation-state outdoing the dominant nation-state.

Today, many “experts” (and I have great disdain for self-proclaimed experts) believe this is the circumstance between the US and China. We are headed toward violent confrontation where there can be only one winner. I read the book by Thucydides about the conflict between Athens and Sparta (I cannot be dispassionate here about that outcome because my family is from Sparta on my father’s side). But I fundamentally disagree with Thucydides’s historical descriptions being used as analysis by anyone to describe global events, especially those between the US and China.

Important and Unknowable

Economists would make one fundamental mistake – Economics is not a science. Human behavior and irrationality, combined with the market’s unpredictability and randomness make predictions mostly useless. Mostly useless means you are destructive. It is...Important and Unknowable

Economists would make one fundamental mistake – Economics is not a science. Human behavior and irrationality, combined with the market’s unpredictability and randomness make predictions mostly useless. Mostly useless means you are destructive. It is...

Important and Unknowable

Economic predictions have always been highly variable and uncertain, and, for some reason, relied upon as if the future were a magical algorithm. Essentially, economists would make one fundamental mistake. They thought they were practicing a science. Data could be collected, inputted, and a predictive algorithm could be generated. Even Nobel Prize winners like Paul Samuelson believed that with enough data we could come to understand the economy and how it functioned.

This is nonsense. As Daniel Kahneman and Amos Tversky have shown us, human behavior and irrationality, combined with unpredictability and randomness (thank you Naseem Taleb) make this even a questionable social science. Using existing analysis and algorithms to reliably forecast is a fool’s errand, essential for someone’s tenure, and maybe even a Nobel Prize, but doesn’t add much that is useful. Some of the more laughable Nobel Prizes have been given to people who determined that markets were efficient. They are not. Economies can be predicted with useful data input. They cannot. A couple of inputs about inflation and the unemployment rate, and we know how to manage an economy. We can’t. That last one is the Philip’s Curve – true for a limited time and then it goes spectacularly wrong – a lot like most risk and market prediction models.

One thing we can add is that most predictions seem too good to be true, and almost always are. The economy is not a perpetual motion machine, nor is it a credit card with no limit and no requirement to pay the balance. The current notion that “deficits don’t matter” seems patently silly and naïve to think that we can simply print money without any economic discipline to generate sustainable profitable businesses with the efficient use of capital.

“Money goes where it’s needed, but it stays where it is treated well.”

Walter Wriston (former CEO of Citicorp)

That means it has to generate a return and not be co-opted by governments and public policy, nor be flooded by capital with no economic discipline.

Deficits may be a reasonable way to jumpstart a sluggish economy, but they are not sustainable. Current thinking is that fiscal discipline, debt repayment, and the idea of a balanced budget are anachronistic and useless. It is dangerous to stress test this idea because the downside is potentially cataclysmic. Capital likes a free market, but we hardly have a free market with money today. Constant stimulus does not create economic discipline.