by Nicholas Mitsakos | Book Chapter, Economy, Public Policy, Writing and Podcasts

The world economy is struggling to escape the Covid-19 economic shock. During the worst of this pandemic, the world’s developed economies provided an enormous fiscal stimulus on a scale not seen since the second world war.

Now, however, the US is proposing to more than double its already generous fiscal stimulus. Is this a good idea or excessively risky?

Go Big, But Where?

For its proponents, the idea of “going big” is designed to be a transformative political moment. But too much appears allocated inefficiently, and it may simply be irresponsible.

An easy money era produced only anemic growth. But the scale and direction of additional stimulus look more like irresponsible fiscal policy leading to significant overheating and the waste of resources. While there is a strong case for a more aggressive approach to fiscal policy, that policy still needs to be grounded in economic realities and reasonable priorities. These are not.

by Nicholas Mitsakos | Book Chapter, Investment Principles, Writing and Podcasts

Risk is the permanent loss of capital.

It is not volatility, nor is it uncertainty. It is the realization of a loss. Therefore, risk is hard to understand because it is only clear with hindsight that a loss has occurred. Understanding how risk works can avoid this permanent loss by avoiding the mistakes that cause the permanent loss of capital.

Risk can also be used advantageously. Knowing that there is the prospect of loss, planning, and investment strategies that profit from these losses put you on the right side of the equation. Risk can be used to an investor’s advantage.

Essentially, anti-fragile (to coin Naseem Taleb’s term) strategies can benefit from volatility, uncertainty, and loss. Randomness permeates all markets, which means risk is always present. Knowing that, investment strategies need to be able to withstand unpredictable or unforeseen stresses. Not all risk factors can be known, or even if potential risks are identified, the magnitude and timing are unknown. What can be certain is that they will occur, and a portfolio that is “fragile” can be devastated

by Nicholas Mitsakos | Currency, Investments, Writing and Podcasts

“I believe that the present, accurately seized, foretells the future.” V.S. Naipaul

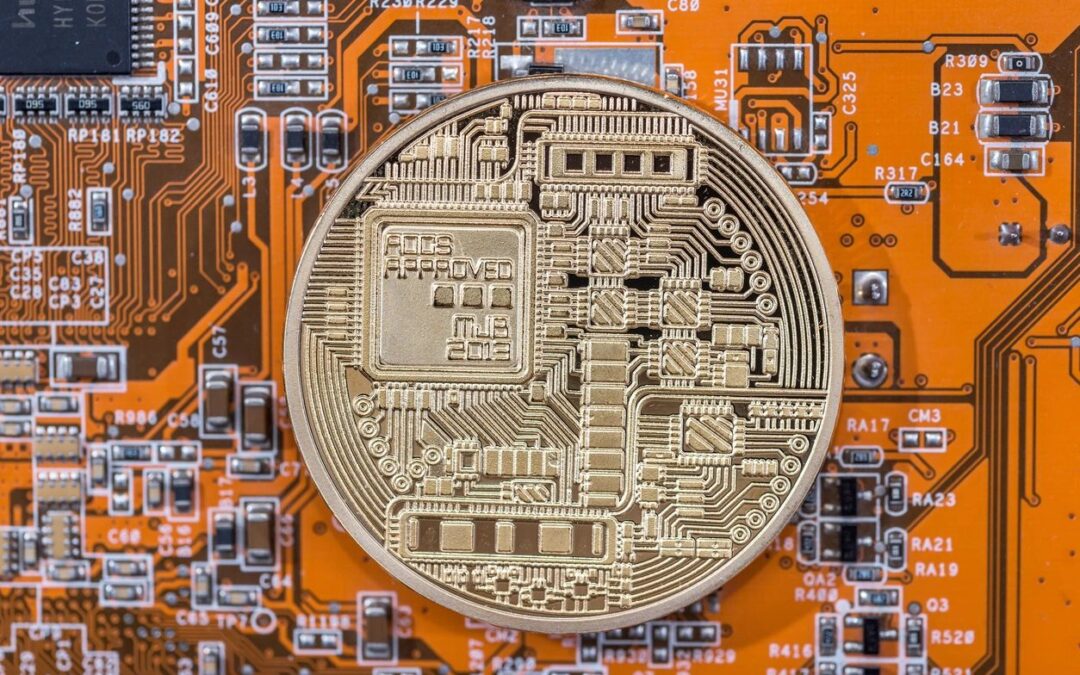

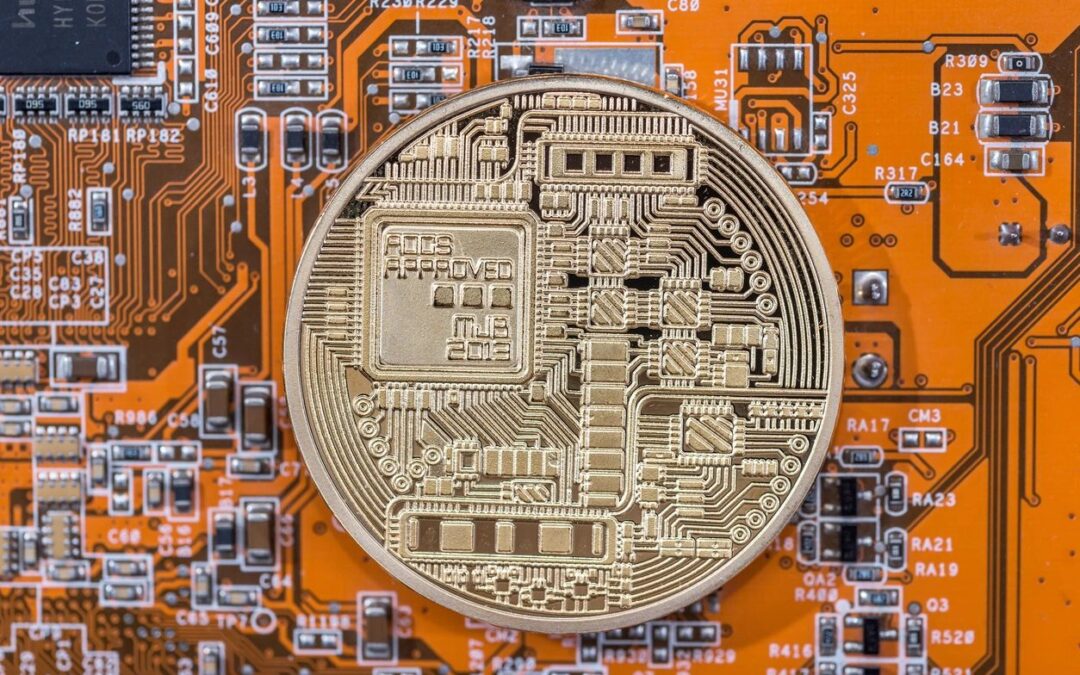

There is a lot of uncertainty today in the markets, but there has always been uncertainty in the markets. We have never had certainty regarding the economy or the future. The most reasonable exercise, as V.S. Naipaul reminds us, is simply to understand the present. So what’s going on? The economy is accelerating. Inflation isn’t a problem. The Fed is going to keep interest rates as close to zero as possible for the foreseeable. These components are driving valuations higher, and in some cases, approaching stratospheric levels. Some concern is warranted in certain sectors, but overall, things seem to be relatively steady and not too overblown. Earnings appear likely to grow, and in many cases, quite rapidly, for the next couple of years – assuming something unforeseeable does not occur (but this probability is not zero). Bitcoin has a few interesting characteristics worth understanding. It is a decentralized, permissionless, peer-to-peer network of computers that’s permanent and unhackable . An investment in Bitcoin is, in reality, a part of the peer-to-peer computer network (essentially, a slot on the database), and almost all of those slots have been allocated. Only 21 million Bitcoins will be produced and 18.5 million have already been mined and circulated. Price is a function of supply and demand (see Economics 101). Arguments about “inherent value” are, and always will be, meaningless. Is there really some kind of “inherent value” in gold? We just decided it was valuable to us. The same is happening with Bitcoin. Bitcoin supply grew 2.5% in 2020; it will grow 2.0% in 2021.The question for Bitcoin valuation is simple: Is demand growing faster or slower than 2.0% annually?

by Nicholas Mitsakos | Book Chapter, Currency, Investments, Writing and Podcasts

Coinbase, Bitcoin, Ethereum, and Dogecoin

Everything you don’t understand about money combined with everything you don’t understand about computers.

Bitcoin and other digital currencies are going mainstream, and along with that, increased volatility. Last week, cryptocurrencies jumped in value as Coinbase, a cryptocurrency exchange, became a publicly traded company worth approximately $100 billion. In other words, trading in digital currencies, with all the expected volatility and unpredictable nature such securities bring, is here to stay.

by Nicholas Mitsakos | Podcast, Writing and Podcasts

Markets are assumed to be predictable, however, with increasing regularity, panicked movements drive valuations. Social media and ubiquitous smartphones are a recipe for increased market volatility and more dramatic supply and demand swings leading to panic and...

by Nicholas Mitsakos | Podcast, Writing and Podcasts

Markets are assumed to be predictable, however, with increasing regularity, panicked movements drive valuations. Social media and ubiquitous smartphones are a recipe for increased market volatility and more dramatic supply and demand swings leading to panic and...

by Nicholas Mitsakos | Podcast, Writing and Podcasts

This discussion highlights that market uncertainty is a constant and increasing influence on investment valuations. Coupled with irrational investment behavior, which permeates market pricing at all times, investment strategies ignoring these components will fail....

by Nicholas Mitsakos | Podcast, Writing and Podcasts

This discussion highlights that market uncertainty is a constant and increasing influence on investment valuations. Coupled with irrational investment behavior, which permeates market pricing at all times, investment strategies ignoring these components will fail....

by Nicholas Mitsakos | Book Chapter, Investment Principles, Writing and Podcasts

Prepare for more frequent and extreme volatility. New and powerful influences, ranging from social media and financial technology to algorithmic trading and esoteric valuation models, will increasingly upset market stability and bring unprecedented rewards and unpredictable disaster.

Predictable market conditions will be upset by sudden unpredictable movements.

Financial markets can be predicted reliably only when the world does not change. Even during periods of stability, judgment based on expectations and assumptions as much as hard facts and economic analysis, form the basis for buying and selling decisions. Market crashes and financial crises are a continuing and breathtaking reminder that markets are irrational and uncertain. Taken to an extreme, the combustible combination disrupts global markets and societies. New analytical tools and technologies appear to make worrying about unforeseen risks obsolete. But this naïve belief in technology’s ability to understand and predict catastrophic risk is a fundamental cause of that very catastrophe.

Stability is illusory because in an uncertain world, unforeseen changes can have seismic effects. The pandemic is only the latest example, but there are always greater risks inherent in markets than is acknowledged, and most investment strategies do not accurately reflect the risk that certain investments are assuming for a given return. Safety can be an illusion if the risks are not well understood, both systemic and undiversified.

As we have seen, oversight, regulation, or any sort of self-imposed moderation will continue to be ineffective or nonexistent, and always trail behind the most dangerous and detrimental market developments. Financial weapons of mass destruction continue to multiply and are now available via smart phone in everyone’s pocket. Expect more and greater turbulence.